Descubre las marcas de nuestras unidades de negocio: Henkel Adhesive Technologies y Henkel Consumer Brands.

4 mar 2021 Düsseldorf / Germany

Henkel delivers overall robust performance in fiscal 2020 despite substantial impact from COVID-19 pandemic

- Balanced portfolio, strong innovations, financial strength, and dedicated team as key enablers for robust business performance in a global crisis

- 2020 results at upper end of full-year guidance:

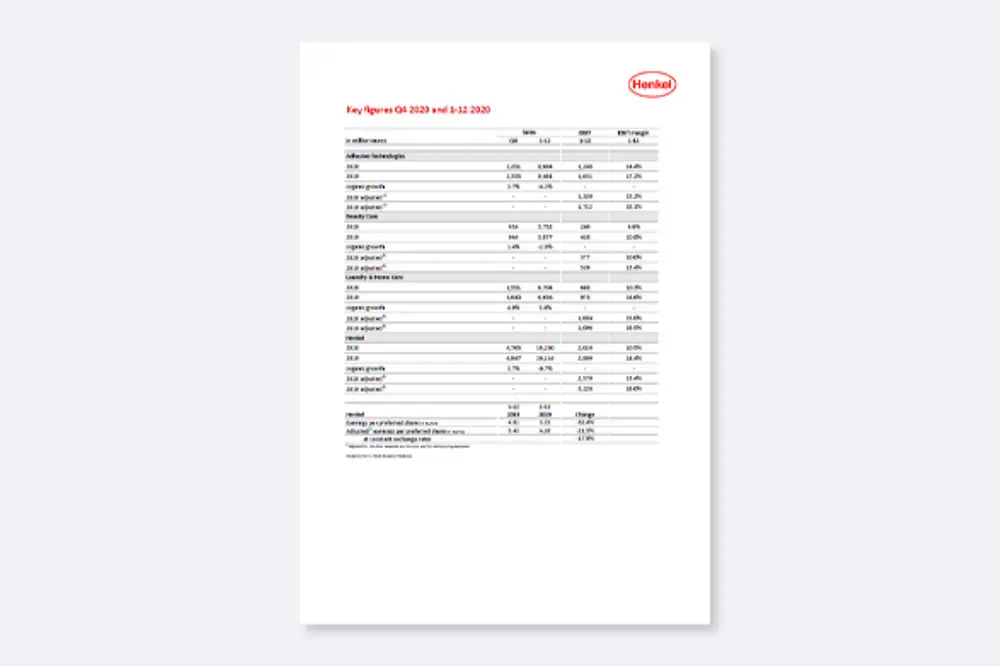

- Group sales reach 19.3 billion euros, organic: -0.7 percent

- EBIT margin* at 13.4 percent, -260 basis points, corresponding to an operating profit* of 2.6 billion euros

- Earnings per preferred share (EPS)*: 4.26 euros,-17.9 percent at constant exchange rates

- Very strong free cash flow of 2.3 billion euros, net financial position significantly improved

- Proposed dividend on prior-year level: 1.85 euros per preferred share

- Implementation of agenda for purposeful growth on track, clear roadmap for further execution in 2021 and beyond

- Outlook for 2021:

- Organic sales growth: 2.0 to 5.0 percent

- EBIT margin*: 13.5 to 14.5 percent

- Earnings per preferred share (EPS)*: an increase between 5.0 to 15.0 percent at constant exchange rates

“Despite the sharp decline of the global economy as a result of the COVID-19 pandemic in 2020, we delivered an overall robust performance across all business units. For the full year, our results were at the upper end of our guidance. We achieved this thanks to our balanced portfolio, successful innovations, and financial strength as well as the outstanding commitment of our employees around the world. I would like to thank all of them for their excellent contributions in this truly challenging year,” said Henkel CEO Carsten Knobel.

“We recorded sales of 19.3 billion euros, slightly below the prior-year level in organic terms, and maintained a profitable business with an adjusted EBIT margin of 13.4 percent. We also generated a very strong free cash flow in excess of 2.3 billion euros, almost at the record level of the prior year. Based on these robust results and given our strong financial base, we will propose a stable dividend to our shareholders at the upcoming Annual General Meeting. Over the past 35 years, since going public, Henkel has always paid out a dividend above or at the prior-year level,” Knobel added.

“During the COVID-19 crisis, we adapted flexibly and quickly to changes in our markets, putting the safety of employees at the top of our agenda. At the same time, we were able to successfully launch and drive the implementation of our strategic agenda across all pillars: shaping a winning portfolio, creating competitive edge by accelerating impactful innovations, by even further integrating sustainability firmly in everything we do, and by driving the digital transformation, and ensuring future-ready operating models. But most important for me, we strengthened our collaborative culture and created a strong momentum for change that will enable us to deliver superior performance and purposeful growth – for our customers and consumers, our company, employees and shareholders, and for society and the planet.”

For the full year, the Adhesive Technologies business unit reported sales below the prior-year level, reflecting a significant decline in demand from key industries. However, thanks to the breadth of its portfolio and successful innovative solutions the business has proven its robustness in a global economic downturn.

The organic sales development in Beauty Care was below prior-year level, strongly impacted by the Hair Salon business due to enforced closures, while the Retail business recorded good growth. This was driven by the successful development of top brands as well as new product launches addressing key consumer trends.

The Laundry & Home Care business unit achieved very strong organic sales growth, fueled by both, the surge in demand for hygiene-related products and by successful innovations, also addressing the increased demand for more sustainable products.

After a strong negative impact on sales due to the pandemic and related shutdowns in the second quarter for Adhesive Technologies and Beauty Care, all three business units reported in the second half of 2020 good organic growth compared to the prior year. The development of the consumer goods businesses, Beauty Care and Laundry & Home Care, was also supported by increased investments in brands, innovations and digitalization.

At Group level, adjusted EBIT decreased by -19.9 percent to 2.6 billion euros. Adjusted return on sales (EBIT margin) was at 13.4 percent, -2.6 percentage points lower than in 2019. Adjusted earnings per preferred share were at 4.26 euros, a decline of -17.9 percent at constant exchange rates.

“The development of our earnings reflects our increased investments which we stepped up as announced in the beginning of 2020 – despite the crisis. Declining demand in key business segments during the COVID-19 crisis also negatively affected our profitability. However, thanks to our successful cost management and the implementation of improved operating models we were able to partially mitigate the impact from the crisis on our earnings,” explained Carsten Knobel.

“As we are managing the current crisis, we remain fully dedicated to our ambitious growth agenda for the coming years. Looking ahead, we are more confident than ever to execute our Purposeful Growth agenda with our global team and successfully shape our future.”

Outlook 2021

“As we enter 2021, we still face a high level of uncertainty how the pandemic will continue to evolve, how quickly the vaccination efforts will progress and how this will impact the widespread restrictions in many countries. We expect that the industrial demand as well as consumer segments which are relevant for our company, in particular the Hair Salon business, will recover. At the same time, we believe consumer demand will return to normal levels in those categories which saw higher demand due to the pandemic. In addition, we assume that current restrictions in many key markets will be lifted in the course of the first quarter and that there will be no widespread shutdowns of retail and industrial businesses as well as production facilities in the remainder of the year,” said Carsten Knobel.

Based on these assumptions, Henkel expects to generate sales and earnings growth in fiscal 2021. The company anticipates organic sales growth of 2.0 to 5.0 percent and adjusted return on sales (EBIT margin) in the range of 13.5 to 14.5 percent. For adjusted earnings per preferred share (EPS) at constant exchange rates, Henkel expects an increase in the range of 5.0 to 15.0 percent.

Group sales and earnings performance in fiscal 2020

At 19,250 million euros, Henkel Group sales in fiscal 2020 were -4.3 percent below the prior-year period. Organic sales growth, which excludes the impact of currency effects and acquisitions/divestments, was slightly negative at -0.7 percent. The contribution from acquisitions and divestments amounted to 0.3 percent. Currency effects had a negative impact of -3.9 percent on sales.

In the face of a significant decline in demand from key industry customers as a result of the COVID-19 pandemic, the Adhesive Technologies business unit reported an organic sales development of -4.2 percent. In the Beauty Care business unit, sales were organically -2.8 percent below the prior-year level, impacted in particular by the challenging conditions for the Hair Salon business in many key regions and markets due to the pandemic while the Retail business recorded good growth. The Laundry & Home Care business unit achieved very strong organic sales growth of 5.6 percent. The development was driven by strong innovations and the pandemic-related increased demand for hygiene products.

Emerging markets showed an organic sales growth of 3.0 percent. Mature markets showed a negative organic sales development of -3.2 percent.

In a market environment that has remained highly competitive, sales in Western Europe showed a negative organic development of -4.4 percent. Eastern Europe achieved organic growth of 7.1 percent. In Africa/Middle East, sales grew organically by 7.0 percent. North America recorded an organic sales development of -2.2 percent. In Latin America organic sales slightly decreased by 0.5 percent. In the Asia-Pacific region, sales decreased organically by -1.6 percent.

Adjusted operating profit (adjusted EBIT) reached 2,579 million euros in 2020 after 3,220 million euros in fiscal 2019 (-19.9 percent).

Adjusted return on sales (adjusted EBIT margin) reached 13.4 percent, -2.6 percentage points below the prior year. The development was also impacted by higher investments in marketing and advertising as well as digital and IT.

Adjusted earnings per preferred share decreased by -21.5 percent from 5.43 euros in fiscal 2019 to 4.26 euros. At constant exchange rates, adjusted earnings per preferred share decreased by -17.9 percent.

Net working capital significantly improved to 0.7 percent of sales, compared to 3.9 percent in the prior-year period.

Free cash flow remained very strong. At 2,338 million euros it almost reached the prior-year level (2019: 2,471 million euros).

Effective December 31, 2020, Henkel’s net financial position improved significantly to -888 million euros (December 31, 2019: -2,047 million euros).

The Management Board, Supervisory Board and Shareholders’ Committee will propose to the Annual General Meeting on April 16, 2021 the same dividend as in the previous year, namely 1.85 euros per preferred share and 1.83 euros per ordinary share. This equals a payout ratio of 43.7 percent, which is above the target range of 30 to 40 percent, reflecting the special nature of the burdens on earnings caused by the COVID-19 pandemic. This payment is possible not least thanks to the strong financial base and low net financial debt of the Henkel Group. Going forward Henkel’s dividend policy remains unchanged.

Business unit performance in fiscal 2020

In fiscal 2020, sales in the Adhesive Technologies business unit were nominally -8.2 percent below prior-year level, reaching 8,684 million euros. Organically, sales development was -4.2 percent. The first half of the year in particular was strongly impacted by the COVID-19 pandemic. However, the second half of the year saw a recovery in demand across all business segments and regions. Adjusted operating profit reached 1,320 million euros (Previous year: 1,712 million euros). At 15.2 percent, adjusted return on sales was below the level of 2019. The margin decline was in particular due to the significantly lower sales volume as a result of the pandemic.

In the Beauty Care business unit, sales in fiscal 2020 showed an organic development of -2.8 percent. Nominally, sales were -3.2 percent below prior-year level, reaching 3,752 million euros. The development is particularly due to the negative impacts of the COVID-19 pandemic on the Hair Salon business while the Retail business achieved an overall good organic sales development. Adjusted operating profit reached 377 million euros (Previous year: 519 million euros). Adjusted return on sales reached 10.0 percent, impacted by the declining sales volume in the Hair Salon business as well as higher investments in marketing and advertising as well as digital and IT.

The Laundry & Home Care business unit generated organic sales growth of 5.6 percent in fiscal 2020. Nominally, sales increased by 0.7 percent to 6,704 million euros. Adjusted operating profit amounted to 1,004 million euros. (Previous year: 1,096 million euros). At 15.0 percent, adjusted return on sales was below the level of 2019, especially due to the higher investments in marketing and advertising as well as digital and IT.

“Purposeful Growth” agenda: Strong momentum

At the beginning of March 2020, Henkel presented the company’s growth agenda for the coming years which focuses on: shaping a winning portfolio, strengthening competitive edge, particularly in the areas of innovation, sustainability and digitalization, establishing future-ready operating models as well as creating a strong and collaborative corporate culture. “This strategic framework will help us to win the 20s for Henkel with a clear focus on purposeful growth. Despite our focus on crisis management in 2020, we were able to launch and start the implementation of our growth agenda. We are fully committed to driving further progress in 2021 and the following years,” Carsten Knobel said.

A key element of Henkel’s future direction is an active portfolio management. Henkel has identified brands and categories with a total sales volume of more than one billion euros, predominantly in its consumer businesses, of which around 50 percent are marked to be divested or discontinued by 2021. The remaining brands and businesses are expected to show sustainable performance improvements. In 2020, already 60 percent of the revenue base of these brands and businesses delivered improved topline momentum.

Despite the market uncertainties in 2020, Henkel already signed agreements to sell, completed the sale or discontinued businesses with an annual sales volume of more than 100 million euros. In the context of Henkel’s active portfolio management, charges of about 300 million euros were booked in 2020, due to a non-cash impairment loss on businesses to be sold or discontinued.

At the same time, Henkel strengthened its portfolio through M&A, leveraging its strong balance sheet. In 2020, Henkel agreed and closed two acquisitions with a combined purchase price of around 500 million euros in its Beauty Care and Adhesive Technologies businesses.

To further strengthen its competitive edge, Henkel is accelerating impactful innovations, boosting sustainability as a differentiating factor, and driving the digital transformation of the company.

In 2020, Henkel increased investments by around 200 million euros compared to 2019 (350 million euros compared to 2018) to strengthen its brands, technologies, and innovations, as well as to accelerate the digital transformation of the company. The investments are showing first tangible results: Henkel was able to increase market shares in many key markets and categories. The company also further accelerated its innovation processes and the launches of new products. This helped, for example, to respond quickly to the strong surge in demand for hygiene, disinfecting and cleaning products with “fast-track innovations”. The focus was on key trends such as hygiene, more natural and sustainable products, and higher convenience.

To accelerate innovation and develop new business models, the consumer business units Beauty Care and Laundry & Home Care have established internal incubator teams, combining agile work approaches with the scale and expertise of a global company: The “Fritz Beauty Lab”, inspired by the company’s founder Fritz Henkel, aims to identify areas with growth potential for existing brands, or white spots to create completely new brands. The Laundry & Home Care business also launched a new sustainability idea factory under the Love Nature umbrella brand, focusing on sustainable solutions in laundry and home care categories. In Adhesive Technologies, Henkel continued its investments in its state-of-the-art innovation center in Düsseldorf. The center, representing a total investment of 130 million euros, is nearing completion, and will become operational in the first half of 2021.

Sustainability is one of Henkel’s great strengths. The company has a leading role that is regularly confirmed in ratings and rankings. Building on this strong track record, Henkel aims to leverage sustainability as a competitive differentiator. In 2020, Henkel successfully continued to integrate sustainability in all its business activities and to drive progress along the entire value chain. Henkel launched new products addressing the rising consumer expectations toward natural and sustainable products, such as solid bars under the Beauty Care brands Nature Box and N.A.E. In the Laundry & Home Care business the Pro Nature product range was expanded and Love Nature, a cross-category sustainable brand, was successfully introduced. In Adhesive Technologies, a new technology under the Loctite brand was developed. It allows the replacement of polyethylene with paper for use in food and non-food packaging. Beyond innovations for more sustainable products, Henkel entered into a virtual power purchasing contract for energy from renewable sources, which will cover the energy demand of all Henkel sites in North America. And Henkel was the first company to issue a plastic waste reduction bond with a volume of around 100 million euros to finance measures to reduce plastic waste across the value chain. The bond underlines Henkel’s commitment to foster a circular economy and reduce plastic waste as well as to Sustainable Finance.

Henkel is pursuing the goal of tripling the value of its operations, products and services in relation to its environmental footprint between 2010 and 2030. On the way to this long-term goal Henkel had defined medium-term targets for 2020. The company was able to achieve the set targets in most dimensions. Overall, Henkel improved its resource efficiency in 2020 by 64 percent compared to 2010.

Next to innovation and sustainability, another key driver in strengthening Henkel’s competitive edge is to transform digital into a customer and consumer value creator across all business units. To enable and accelerate this process, Henkel created a new unit in 2020, Henkel dx, combining Digital, Business Process Management and IT expertise in one global organization. Henkel dx has opened its first innovation hub in Berlin and plans to expand its global network with more hubs in the future. In the course of 2020, the share of sales across digital channels increased substantially, with all business units benefiting. Overall, digital sales at Henkel increased by about 20 percent, with the consumer businesses combined delivering growth of more than 60 percent. For the Group, the digital share in overall sales further increased and climbed to around 15 percent.

Lean, fast and future-ready operating models are important elements of Henkel’s strategic framework. To ensure this and to improve competitiveness and efficiency, the company continuously adapts and reshapes processes and structures across the entire company. In doing so, Henkel aspires to enable new business models, to step up customer and consumer proximity with faster decision-making, and to further increase efficiency. Through the introduction of new organizational structures in the Adhesive Technologies business unit in 2020, Henkel was able to address and serve specific customer segments and markets even better. In the Beauty Care and Laundry & Home Care business units, Henkel implemented further organizational changes to enable a stronger regional focus and increase customer and consumer proximity.

Further developing Henkel’s corporate culture and accelerating the cultural transformation is at the heart of Henkel´s “Purposeful Growth” agenda. The company aims to foster a collaborative culture with empowered people and with its leadership commitments at the core. In 2020, Henkel launched a range of measures to advance a culture of collaboration and empowerment, upskill employees for future capabilities and enable its people to grow and develop – personally and professionally. Henkel conducted a global Organizational Health Survey to identify strengths and areas for improvement, and to design the cultural journey going forward. The efforts to continuously adapt and evolve its culture and to remain an attractive employer of choice were also reflected in marked improvements in key employer reputation rankings and benchmarks.

“I am proud of the progress we have made with the implementation of our strategic agenda while addressing a global pandemic. I am impressed by the resilience of our business, which has enabled us to achieve a robust business performance and to further strengthen our financial foundation. But the most important feeling is gratitude and heartfelt respect for our employees at Henkel. The performance, collaboration, and positive attitude they have shown in 2020 has touched and inspired me. I would like to thank all of them for their invaluable contributions in this truly exceptional year,” Carsten Knobel summarized.

* Adjusted for one-time expenses and income, and for restructuring expenses.

This information contains forward-looking statements which are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. Statements with respect to the future are characterized by the use of words such as “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, and similar terms. Such statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update any forward-looking statements.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.